An innovative medical first approach to health and life insurance.

You can provide feedback or make a complaint to our network Sesame. Please contact them on the details below: Write to: The Customer Relations Department, Sesame limited, Fourth Floor, Jackson House, Sibson Road, Sale, M33 7RR. Email: CustomerRelations@sbg.co.uk | Telephone: 0345 0456 800 (Mon-Fri 9 am to 5 pm)

Why we are different

Eliminate barriers to obtaining health and life insurance by managing the complete customer journey. We mitigate health risks and identify the most competitive insurer based upon on your precise medical profile not basic indicative quotes.

Other Brokers

Mostly act like a comparison website and hand you over directly to deal with an insurer based upon speculative indicative quotes not your precise medical profile.

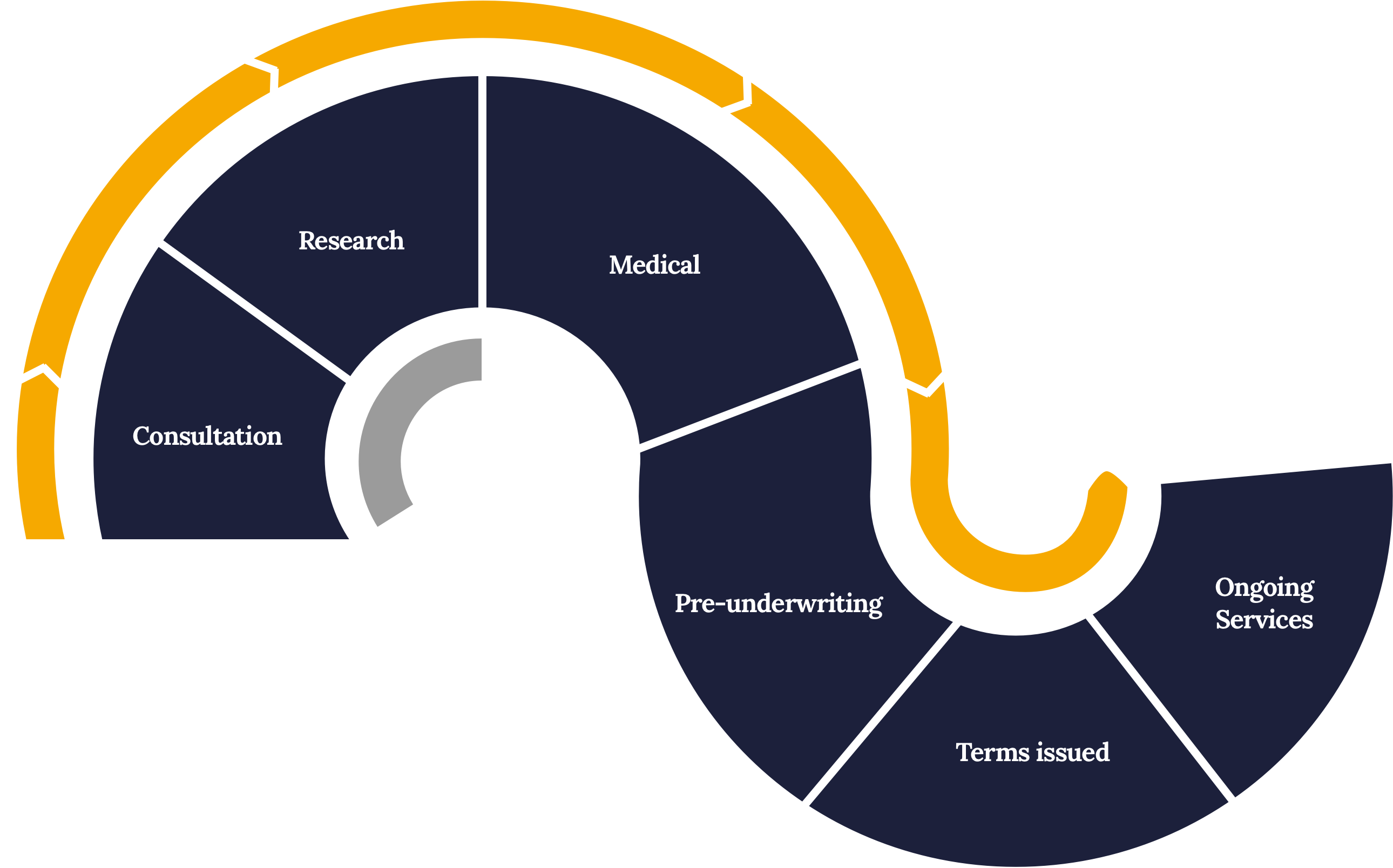

Managing the complete customer journey.

- Personal face to face meeting.

- Identify and understand your aims and concerns.

- Discuss protecting your financial priorities.

- We work for you and are completely transparent.

- Over 40 years of combined financial services experience.

- In depth knowledge of the complex nature of medical and financial underwriting.

- Extensive network of specialist legal, tax and financial advisers.

- Access to products based on an analysis of a number of insurers

- Individually tailored products and solutions.

- A medical at a convenient time and location to suit you.

- National coverage with the ability to arrange medicals at home, work or a local clinic.

- Extensive network of specialist medical consultants and clinics.

- Dedicated team who source, book and coordinate your medical.

- Continued support and guidance if further medical information is required.

- Your precise medical data is anonymised and sent to a range of insurer.

- Your medical data is assessed to highlight any areas of concern.

- We compile and present the financial case to your insurer.

- Insurer is identified based upon their feedback on both medical and financial underwriting.

- We advise you of the final terms that we have negotiated.

- We produce, compile and complete all the paperwork.

- Where necessary we will liaise with employers, family members, trustees etc.

- Once completed your cover is activated quickly and efficiently.

- We will forward packs containing all the relevant information to your clients.

- Main point of contact between client and insurers.

- Access to up to date industry news, products and regulation.

- In house research.

- Continued advice and guidance.

- Record keeping.

Protecting your business and family

Key Person Insurance – What would be the impact on your business if a key member of staff was to die or suffer a critical illness?

Shareholder protection – Would your business have sufficient capital to buy out an existing shareholder in the event of a death or suffering a critical illness?

Death in service (Relevant Life Cover) – Would you and your staff benefit from a tax efficient, individual company paid death in service insurance coverage that is portable and does not form part of your lifetime pension allowance (unlike conventional group schemes)?

Family Protection – What would the effect be on your family if either parent was to die or suffer a critical illness?

Mortgage/Loan protection – Would you be able to pay for your mortgage/loan repayments in the event of a death or critical illness?

Income Protection – How would your family cope if you were unable to work for a period of time?

Inheritance Tax – Are your children or grandchildren able to pay the tax associated with your estate in the event of your death?

- High cholesterol, raised blood sugar levels, liver function.

- Body mass index (BMI), raised blood pressure, lifestyle.

- Family history of heart disease, stroke, cancer and diabetes.

We work with our clients to help improve or mitigate the impact of the above conditions on the cost of their insurance.

HSL Assured is a comprehensive, family-run, insurance brokerage with over 40 years of combined financial services experience.

All of these life experiences conspire to create a company esprit de corps that drives innovation, integrity and the desire to find our clients the cover that best suits their needs. As a family business we know first-hand the importance of protecting your family and your business.

Leadership Team

Dennis Guise, Co-Founder

Dennis is the co-founder of HSL Assured and is a survivor of aggressive prostate cancer. This experience coupled with a critical illness insurance payout led him to self-financing Healthscanlife and HSL Assured to highlight the link between early health detection and insurance. Dennis’s long career in insurance started as an underwriter with ANP in his native New Zealand, before joining J Rothschild Assurance (now St James’s Place). Dennis was one of the first principle partners and specialised in selling share purchase and keyman insurance to SMEs. Dennis’s primary role is business development as well as identifying new commercial ventures.

Deborah Guise, Director

Deborah (Deb) has worked in the financial services industry for over 30 years and has worked with Abbey National, Henderson (now Henderson Global Investors) and St James’s Place, before co-founding HSL Assured with her brother Dennis in 2011. Deb’s principle role is to ensure HSL Assured’s professional standards are maintained throughout the business, with a particular focus on compliance. Deb is passionate about HSL and truly believes it to be a unique, client-focused business underpinned by integrity and service.

Martin Gwilliam – Underwriting Consultant

Martin has 40 years’ experience in life and disability underwriting and claims environments in both the insurance and reinsurance markets in the UK and Australia. He brings considerable knowledge and experience on risk assessment aligned to product development and has joined HSL Assured as a consultant on underwriting and claims issues focused on maximising favorable outcomes for clients based on their health profiles. When not working Martin enjoys being on the golf course, is an avid rugby and cricket follower enjoys dog walking and is partial to the occasional glass of red.

Dinesh Thakrar – Finance

Dinesh is a new member of the team at HSL and has worked as a management Accountant and Bookkeeper with a proven track record of success over 40 years in various industries including automotive (retail sales & drag racing), construction, real estate (management/lettings/refurbishment/development), financial services, gas importer, printing industry, nursing care and wholesale market sectors. Providing high-level strategic financial planning and management control to build consistently improving business financial performances.

HSL Assured partners with a distinguished list of both trusted healthcare providers and well established insurance companies.

As a comprehensive insurance broker we are not tied to any one insurer. We partner with most of the major insurers so that we are able to offer our clients the most competitive costs and products. Our strong relationship with most of the major insurance underwriters means we can achieve terms quickly and efficiently.

Our partnerships with nationwide healthcare providers lets us conduct an internal pre-underwriting process to help control and decipher the brokering of health and life insurance. It also ensures that we can arrange a medical at a convenient location to suit you.

Client testimonials.

David Ramm, Partner at Crowell & Moring LLP

“HSL organised my health screen and review of insurance, and to my surprise my Liver Function Tests and Cholesterol were raised which resulted in my life insurance and critical illness premiums being higher than they should be. After getting the right advice and a 3 month course of Deliverance·; all my markers were reduced and my insurance premiums have similarly reduced by over 50%”

Steve Dorrington, CFO at Phoenix Equity Partners

“By working with Dennis and team, we have been able to include health and wellbeing as part of a coherent risk management program. Integrating HSL into our due diligence process, we undertake full medicals on a management team prior to an investment and then use that medical information to get the best possible rates on any Keyman, Share Purchase or Life Insurance required.”

Peter Ibbetson, Chairman of Small Business Banking RBS

“As a 60 year old with type 2 diabetes I assumed I’d be penalised, as has been the case with previous insurance applications. Yet HSL delivered cover for me at rates that suggested I was a fully fit 40 year old. They were empathetic, efficient and professional.”

Stephen Moss CBE, Chairman of Bibendum Wines and Springboard Charity

“I have found HSL Assured to be extremely professional – they really understand their area of the insurance market and what I liked was their ability to think outside the box and find solutions that worked well commercially as well as delivering the required cover.”

Andrew Harting, CEO, HWM Aston Martin

“HSL provides an end to end custom life assurance solution. From establishing the right product, arranging health checks, testing the market and delivering the right product at an attractive price, they offered a courteous, discreet and competitive service.”

Michael Simmonds, Partner, Risk Capital Partners

“We use HSL because they take control of the process. We are most likely to get the lowest premium and stand the best chance of covering specific risks. They are a professional agency and earn their fee.”

Simon Holmes, Golf coach to Major Champions and with 50 tour victories

“HSL’s insurance advice has saved me £500 per month and I now have better cover for my family. My existing advisor wholeheartedly approved HSL Assured’s recommendations for life, critical illness and PMI insurance for my wife and myself.”